Understanding The Difference Between Actual Cash Value And Replacement Cost

Understanding the Difference Between Actual Cash Value and Replacement Cost

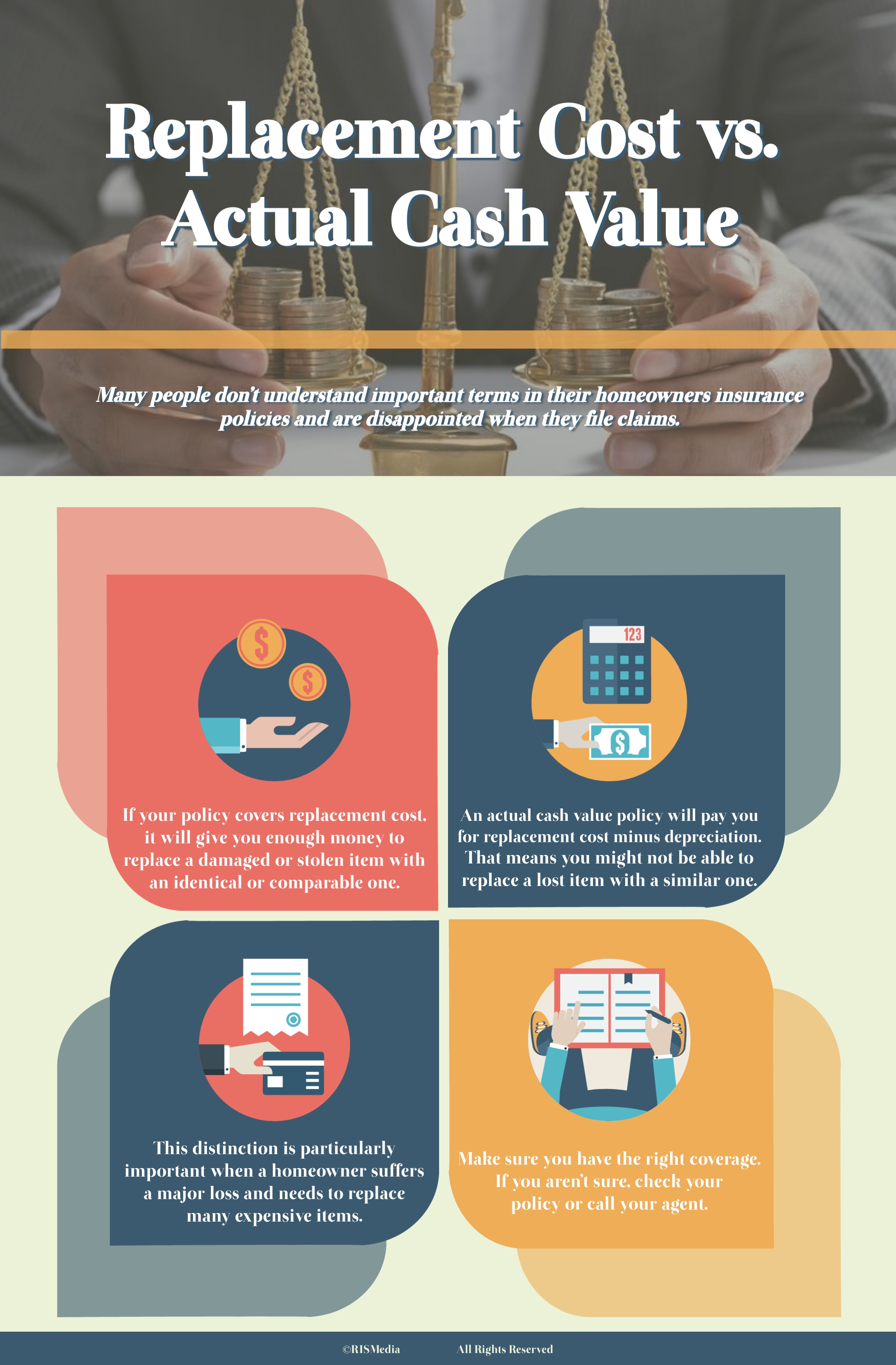

As a homeowner or business owner, you’re likely familiar with the importance of insurance in protecting your investments. However, understanding the nuances of insurance policies can be overwhelming, especially when it comes to the terms "Actual Cash Value" (ACV) and "Replacement Cost" (RC). In this article, we’ll break down the differences between these two concepts, helping you make informed decisions when it comes to insuring your valuable assets.

What is Actual Cash Value (ACV)?

Actual Cash Value (ACV) is the value of a damaged or lost item at the time of the loss, considering its depreciation. This means that if you file a claim, the insurance company will pay out the ACV of the item, which may not necessarily cover the full cost of replacing it. ACV takes into account the item’s original purchase price and its decrease in value over time due to wear and tear, aging, or technological advancements.

For example, let’s say you purchased a new laptop for $1,000 two years ago. Today, the laptop’s ACV might be $600, considering depreciation. If the laptop is damaged or stolen and you file a claim, the insurance company will pay out the ACV of $600, leaving you to cover the remaining $400 to purchase a new laptop.

What is Replacement Cost (RC)?

Replacement Cost (RC) is the cost to replace a damaged or lost item with a brand new, identical or similar one, without deducting depreciation. This means that if you file a claim, the insurance company will pay out the full cost of replacing the item with a new one, as if you had just purchased it. RC does not take into account the item’s original purchase price or depreciation.

Using the same example as above, if your laptop is damaged or stolen and you file a claim, the insurance company will pay out the RC of $1,000 (the cost of a new laptop), without deducting depreciation.

Key differences between ACV and RC

- Depreciation: ACV takes depreciation into account, while RC does not. This means that ACV typically pays out less than RC.

- Payout: ACV pays out the item’s current market value, while RC pays out the full replacement cost.

- Cost: RC coverage often comes with higher premiums, as it offers more comprehensive coverage.

- Value: ACV is based on an item’s value at the time of loss, while RC is based on the cost to replace it with a new, identical or similar item.

Which one is right for you?

The choice between ACV and RC ultimately depends on your individual circumstances, financial situation, and risk tolerance. Here are some factors to consider:

- Budget: If you’re on a tight budget, ACV coverage may be more affordable in the short term, but you’ll need to consider the potential out-of-pocket costs if you need to replace an item.

- Assets: If you have valuable items that are likely to appreciate over time, such as antiques or fine art, RC coverage might be a better option to ensure you can replace them with identical or similar pieces.

- Risk tolerance: If you’re comfortable with taking on more risk and can afford to cover the difference between ACV and RC, ACV coverage might be sufficient.

- Insurance premiums: RC coverage often comes with higher premiums, so consider whether the added cost is worth it for your specific situation.

Tips for managing ACV and RC

- Regularly review your policy: Ensure you understand your policy and make adjustments as needed.

- Keep records: Keep receipts, appraisals, and records of your assets to support your claims.

- Consider add-ons: Some policies offer add-ons, such as "ACV+," which combines ACV with a small depreciation allowance.

- Inspect your assets: Regularly inspect your assets to ensure you’re insured for their full value.

- Consult with an insurance professional: If you’re unsure about ACV or RC coverage, consult with an insurance professional to determine the best approach for your unique situation.

Common mistakes to avoid

- Underinsuring: Don’t underinsure your assets, as this can lead to financial loss in the event of a claim.

- Assuming RC coverage: Don’t assume your policy includes RC coverage; review your policy documents carefully.

- Not reviewing your policy: Failure to review your policy regularly can result in missed opportunities for adjusting your coverage.

- Inaccurate valuations: Ensure accurate valuations of your assets to avoid disputes during the claims process.

Conclusion

Understanding the difference between Actual Cash Value and Replacement Cost is crucial for ensuring you have adequate insurance coverage. By considering your individual circumstances, assessing your risk tolerance, and regularly reviewing your policy, you can make informed decisions about the type of coverage that’s right for you. Remember to avoid common mistakes and consult with an insurance professional if you’re unsure about ACV or RC coverage.

Final Tips

- Stay informed: Stay up-to-date with industry developments and changes in insurance regulations.

- Be proactive: Regularly review and update your policy to ensure it reflects your changing needs.

- Consider bundling: Bundling insurance policies can lead to cost savings and streamlined management.

- Prioritize: Prioritize your assets and focus on insuring those that are most valuable or critical to your business or personal life.

By following these tips and understanding the nuances of ACV and RC, you’ll be better equipped to navigate the complex world of insurance, protecting your investments and ensuring financial peace of mind.

Loker Morowali Informasi Lowongan Kerja Morowali dan Sekitarnya